Telematics has over the decades reshaped the transportation industry. Fleet management (FM) systems based on satellite positioning and wireless communication have gradually been established as crucial enablers of business-critical functionality such as vehicle, transport and driver management, and regulatory compliance and reporting, as Rickard Andersson writes.

In North America, the growth of the FM solutions market has been propelled by regulatory developments such as CSA (Compliance, Safety, Accountability), and the market is now also driven by the forthcoming ELD/EOBR (Electronic Logging Device/Electronic Onboard Recorder) mandate.

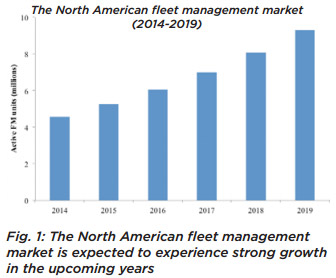

The number of FM systems in active use on the North American market is forecast to grow at a compound annual growth rate (CAGR) of 15.3% from 4.6 million units in 2014 to 9.3 million units by 2019. The top 10 fleet management providers in North America already represent more than half of the active units in the region. The industry is in a consolidation phase involving local as well as international providers. Berg Insight anticipates a future scenario where the global fleet management market is dominated by a handful of providers with installed bases measured in the millions.

Technology developments and operator involvement

Most FM solutions are today delivered using SaaS models based on monthly subscriptions granting fleet customers access to web-based portals. There is also a general shift in the telematics hardware footprint from specialised on-board computers towards greater use of standardised off-the-shelf hardware and even mobile platforms for certain applications.

Many mobile operators active in the M2M/IoT market have diversified beyond mere machine-to-machine communication to also offer end-to-end solutions to business customers within various verticals such as transportation. Solutions are oftentimes offered in partnership with established FM providers and mobile operators have increasingly come to play an important role as a sales channel enabling wide reach among fleet-owning companies. Subscription fees for fleet management services can in some cases even be conveniently charged on the customer’s phone bill.

AT&T in the transportation sector

senior analyst at Berg Insight, is focused on the telematics market.

He holds an MSc in

Industrial Engineering

and Management from Chalmers University of Technology

AT&T has extensive experience in serving the US transportation market. Out of AT&T’s close to 20 million connected devices in service, transportation-related M2M applications account for around 3 million units in North America. Nine out of the top 10 fleet management solution providers on the US market use connectivity services from AT&T.

A specific focus on the transportation vertical was launched nine years ago when the company started moving beyond M2M communication to develop in-house expertise for sales of fleet management solutions to its business customers. AT&T today has 7,000 sales people trained to sell transportation solutions such as FM and 50 specialists are specifically focused on the transportation sector. In addition to commercial vehicles and its drivers, the company also offers solutions for other assets including trailers, containers and equipment in the field.

Fleet management portfolio

AT&T employs a partnering strategy and works with a number of well-known solution providers. The company resells FM offerings from partners including Complete Innovations, Webtech Wireless and NexTraq using AT&T branding. The AT&T Fleet Complete suite is powered by Complete Innovations and includes the Fleet Tracker, Asset Tracker and Action Tracker products, tailored to track and communicate with fleet vehicles, assets and mobile workers respectively. AT&T Fleet Manager and AT&T Fleet Driver Center are provided by Webtech Wireless. The former is a telematics solution suitable for commercial fleets including transportation and service companies as well as government fleets, while the latter among other things enables compliance with FMCSA and DOT regulations. The solution portfolio furthermore includes AT&T Fleet Center which is an affordable and easy-touse vehicle tracking and FM solution powered by NexTraq.

XRS from AT&T in addition provides a complete ELD solution based on a small piece of hardware that is paired with a mobile device via Bluetooth, powered by the Omnitracs subsidiary XRS. Mobile resource management (MRM) solutions from Actsoft are also part of AT&T’s portfolio of mobile productivity solutions. The company furthermore works with additional solution partners to fulfil specific customer requirements, commonly using a co-selling model.

Customers and common use cases

AT&T’s full portfolio supports basic fleet tracking needs as well as consultative selection of more advanced solutions. Fleets commonly adopt telematics systems from AT&T to improve fleet management efficiency, proof of delivery and driver productivity by using applications supporting dispatching, routing, tracking, reporting and reduction of paperwork. Regulatory compliance, back office integration, work order management and temperature monitoring for refrigerated transports are other examples. The company serves customers having various light to heavy vehicles across all types of segments, from small field service fleets up to heavy duty trucking operations. Key segments are for example government, utilities, for-hire and LTL. Examples of customers include Saia, ConWay and Asplundh Tree Expert. The latter has adopted a fleet management system provided by AT&T in partnership with Telogis.

Competitive pressures on the US market

Basic fleet management needs can be fulfilled by a wide range of providers. AT&T however portrays itself as being in an advantageous position to serve higher-end customer demands and largevolume accounts. The main competitors are the other major US operators including Verizon, Sprint and to some extent T-Mobile. The specialised fleet management solution providers are moreover seen as potential partners rather than competitors.

AT&T describes its fleet management service portfolio as one of the broadest and most complete on the market. The company sets itself apart from the competition by working with a strong ecosystem of partners, offering a range of solutions designed to appeal to the needs of all segments in the transport sector. AT&T’s history of success on the transportation market as well as its network and global SIM capabilities are further pinpointed as differentiators.

Future trends and IoT developments

AT&T has identified a number of trends related to transport and telematics. Truck OEMs are to an increasing extent expected to factory-fit onboard hardware on their vehicles, while aftermarket FM providers focus on software solutions. The under-penetrated SMB market is characterised as an important target for future fleet telematics sales given the substantial opportunities among current non-adopters. Regulatory developments including the ELD/EOBR mandate are moreover expected to drive sales in the heavy duty truck segment in the coming years. Other trends are related to safety-oriented reporting and immediate feedback to drivers.

There is moreover increasing demand for invehicle Wi-Fi hotspot capabilities, as well as solutions that improve the work environment for truck drivers by emulating the experience of connected passenger cars, thus contributing to improved driver retention. Fleets are in the future expected to use vehicle data in a more analytical fashion together with other types of data sources to realise efficiencies, including the use of predictive capabilities for maintenance as well as operations. The Internet of Things is – together with Big Data – expected to create a marketplace for data analytics, feeding into decision support for fleet management and other solutions.

The author is Rickard Andersson, senior analyst at Berg Insight.