In July 2015, M2M research firm Berg Insight will publish its latest market research report on mobile location-based services, which provides a global view on the use of mobile LBS in a number of categories. Mobile location-based services include applications and services that in some way utilise the known location of a handset. Adding location information can enhance an existing service or enable entirely new applications.

An example of the first case is location enhanced search services that use location as a filter in order to present relevant content. In the second case, location is used as an enabler for new applications that are fully dependent on knowing the location of a person or asset; for instance navigation and tracking services. Today, an assortment of consumer and enterprise services make use of automatic location of devices or other assets, based either on wireless network location technologies or on GPS and Wi-Fi chipsets in handsets. Such services are marketed by mobile network operators, handset vendors as well as service providers and countless app developers.

Berg Insight estimates that roughly 350 mobile network operators in more than 60 countries worldwide have deployed at least some type of basic location platform to enable location of mobile phones for emergency calls and deliver commercial services. However, especially in developed countries, mobile operators are no longer the central players in delivery of mass market value-added mobile services. This role has largely been taken by smartphone platform vendors and over-the-top app providers. For the majority of services and apps, the main source of location data is now obtained from smartphone APIs and third party location platform services. Growing adoption of smartphones with on-device app stores has attracted developers that can now reach users on a global scale directly, without having to collaborate with multiple operators in several countries. App stores have also enabled new business models that are better suited for many developers that increasingly rely on ad-funding, freemium models and indirect revenues.

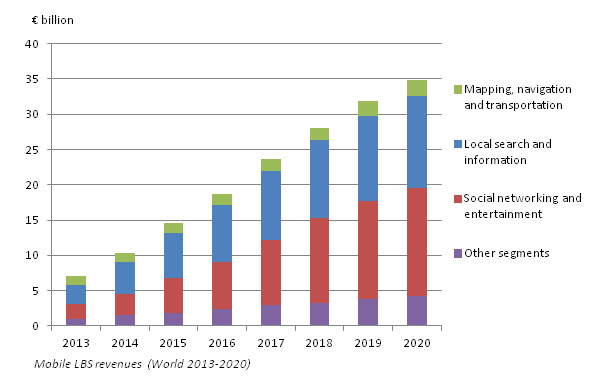

Along with the increase in smartphone adoption, use of mobile LBS is also growing globally. Most of the commonly used apps and services in categories like messaging, social networking and mobile search are now location-enabled. The increase in usage and the number of active users has also resulted in considerable revenue growth. Consumer-oriented LBS revenues reached an estimated € 9.9 billion worldwide in 2014, accounting for more than 95 percent of total consumer and enterprise LBS revenues. Consumer-oriented LBS revenues are forecasted to reach over € 33 billion in 2020 and total global LBS revenues are forecasted to grow to € 34.8 billion in 2020. Nevertheless, revenues are far from evenly distributed among app developers and service providers. Leading Internet players including Google, Facebook, Baidu, Tencent, Twitter and Yahoo! that have drawn large and active audiences to their services also attract the majority of ad spend.

The social networking and entertainment category is now the largest LBS segment in terms of number of users and the second largest is terms of revenues. It comprises a broad set of services that can be segmented into general social networking, messaging apps, friendfinders and games. The mobile channel has become a priority for the leading social networks that see rapid growth in access from mobile devices. Revenue growth in the category comes from a larger active user base and the fact that more leading players have started to monetise their mobile services, primarily through ads and in-app purchase of content such as virtual goods. The local search and information service category, which includes general search services, directories, local discovery, shopping and coupon services, is now the second largest LBS category in terms of unique users, but the largest in terms of revenues. Mapping, navigation and transportation is the third largest segment both in terms of revenues and in terms of number of active users. Although the number of active users of mapping and navigation services is still growing, revenues are only increasing slowly as competition from free and low cost services has intensified. More navigation app developer are now focusing on freemium apps where the core navigation service is free and users have the option to purchase additional content and features. The service category also includes a number of apps that for instance enable users to find information about traffic and public transport, or facilitate car rental and ride sharing services. These top three LBS segments accounted for roughly 85 percent of total LBS revenues worldwide in 2014.

Although over-the-top players now dominate the LBS ecosystem for consumer oriented apps and services, mobile operators still have an opportunity to monetise their network and platform assets. Many operators are now looking for new opportunities to enable various forms of enterprise and B2B services. Location data can be used to enhance a broad range of services such as fraud management, secure authentication and location-based advertising. Some operators have also launched analytics services based on aggregated and anonymised data from their networks including location, CRM and service usage. A growing number of customers use the insights for applications such as site selection and footfall monitoring in the retail industry, outdoor media planning for advertisers, as well as for urban planning and traffic monitoring.

For more information on this forthcoming 200-page strategy report on the mobile location-based services market contact johan@berginsight.com